QIC Group reports 11% growth in Net Profits in H1 2024

Highlights in H1 2024

- Gross Written Premiums for H1 2024 of QAR 4.8 billion.

- Domestic and MENA operations Gross Written Premiums increased by 44% in H1 2024.

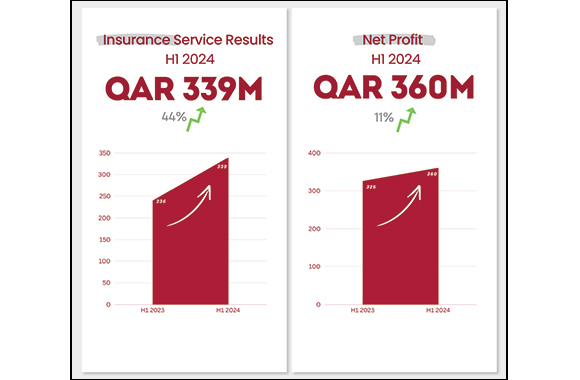

- Insurance service results of QAR 339 million in H1 2024, compared with QAR 236 million for the same period in 2023.

- Consolidated net profit for H1 2024 of 360 million, compared with QAR 325 million for the previous year.

Doha, Thursday, 15th August 2024

Qatar Insurance Company (“QIC Group”, “QIC”), the leading insurer in Qatar and the Middle East and North Africa (MENA) region, has reported a net profit of QAR 360 million for the first half of 2024, rising 11% from QAR 325 million over the same period in 2023. Following a meeting of the Board of Directors dated 14 August 2024, which was presided over by Sheikh Hamad bin Faisal bin Thani Jasim Al Thani, Chairman of QIC Group, the Board approved the financial results.

Sheikh Hamad bin Faisal Al Thani, Chairman of QIC Group, stated: “QIC’s excellent H1 financial results reflect the strong momentum the company has built in the first six months of 2024. The Group is focused primarily on growing its presence in domestic and regional markets – an approach which has been bolstered by continued investment in its already best-in-class digital services.”

Mr. Salem Al Mannai, Chief Executive Officer of QIC Group, said: “In a very promising set of results for H1 2024, the backbone of QIC’s robust financial performance continues to be the company’s exceptional operational efficiency, supplemented by a deliberate shift towards increasing the proportion of premiums generated in the MENA region. This is reflected in the fact that the domestic and MENA GWP increased by 44% year-on-year to QAR 2.7 billion. As we move into the second half of the year, QIC is proactively pursuing further opportunities to create process efficiencies and foster automation, while continuing to prioritise growth in its profitable business lines in Qatar and the Middle East.”

Mr. Mannai added: “The strategic restructuring of our UK motor business is in line with QIC Group's strategy to streamline loss-making and low margin businesses and to bring the international operations of the Group back to profitability. This restructuring positions the Group for greater stability and profitability with controlled exposure to UK Motor as a reinsurer instead of direct insurer. As part of this decision, QIC Group will continue to own the Gibraltar-based subsidiaries, West Bay Insurance Plc and Markerstudy Insurance Co. Ltd. By successfully completing this restructuring, the Group is confident that it will have a well balanced portfolio between its MENA and international business. We are pleased with the outcome, and we look forward to further implementing our strategy, which has, so far, brought us significant success and improved consistent profitability.”

Mr. Mannai further added: “Looking beyond these financial results, everyone at QIC can be tremendously proud of what we have achieved in the first half of this year. The company has once again won several respected industry awards – including being named ‘Insurer of The Year in Qatar’ at The MENA IR Awards for the third year in a row and gaining widespread recognition for its exceptional digital services. We have brought together the leading experts in the region’s insurance sector to analyse and explore one of its most significant trends: the increasing prevalence and utility of AI. We have also supported a number of extremely worthy initiatives, from children’s early education in insurance matters to grassroots and professional sporting events”.

Financial overview

The global macroeconomic environment showed some signs of stabilisation in the first half of 2024, particularly as inflation receded across much of the world.

While the catastrophic events in the first half of 2024 continued to impact global insurance markets, QIC with its now balanced portfolio mix has been able to successfully weather the challenges. During the first half of 2024, UAE witnessed multiple floods, highlighting the increasing frequency and severity of extreme weather events, leading to multi-billion dollar insured motor and property losses that were largely absorbed by the international reinsurance industry. The recent catastrophic losses in the region, may lead to market rate hardening, as insurers and reinsurers adjust their pricing to account for the heightened risk. Meanwhile, in the US city of Baltimore, the collapse of the Francis Scott Key Bridge led to what was considered one of the largest single marine insurance losses ever – ultimately amounting to $4 billion, according to some estimates.

Prioritising growth in domestic and regional insurance markets

With global macroeconomic conditions potentially improving but still uncertain, and geopolitical risk remaining high, QIC has been steadfast in its longer-term strategy of focusing on profitable markets in Qatar and the MENA region, while exiting loss making and low margin international businesses. This is showcased by the increase in GWP from its domestic and MENA operations by 44% in H1 2024, compared to the same period last year. QIC currently has a balanced and well diversified portfolio with 57% of its insurance business written by the MENA entities and 43% of business underwritten by the international operations.

With regards to its lines of business, QIC has recently focused on growing its personal lines and health insurance divisions, as well as marine & energy insurance. While the company’s exposure to the international motor insurance market has been intentionally reduced – particularly in the UK, as a result of supply chain challenges largely induced by Brexit – it continues to prioritise its award-winning motor insurance business in the MENA region. More broadly, QIC’s international insurance operations, which have been successfully slimmed down over the past few years, are exhibiting healthy combined ratios.

The Group posted Insurance Service Results of QAR 339 million in H1 2024, compared to QAR 236 million in H1 2023.

Investment performance

QIC has shown considerable resilience to navigate the aforementioned global challenges, reporting an investment income of QAR 465 million for H1 2024, compared to QAR 501 million for the same period last year. The return on investment stood at 5%.

As of the end of H1 2024, the composition of QIC’s investment portfolio continues to remain stable and consistent with the previous year.

Key areas of focus

Industry awards

Over the first half of 2024, QIC was honoured with a number of prestigious industry awards. Among these:

- QIC was named ‘Insurer of The Year in Qatar’ at The MENA IR Awards 2024 in January for the third consecutive year, recognising the company’s exceptional product digitisation and customer service.

- QIC was awarded ‘Best Travel Insurance Company in The Middle East’ for the second consecutive year at the Global Banking & Finance Review Awards 2024. This accolade recognised the company’s outstanding services for both outbound and inbound travellers, including its online experiences and extensive coverage.

- QIC received three titles at the Global Brands Magazine Awards 2024, being crowned ‘Best Digital Insurance Brand in Qatar’, ‘Best Insurance Website in Qatar’, and ‘Best Car Insurance Mobile App in Qatar’.

- QIC’s Drive mobile app and its contribution to levelling up the digital experience of motorists in Qatar was recognised by the Insurance Asia Awards 2024, awarded the ‘Mobile App of The Year in Qatar’.

QIC Insurtech summit explores the future of insurance in the age of artificial intelligence (AI)

In May, QIC held the third edition of its annual MENA Insurtech Summit 2024, the premier event for insurance and insurtech stakeholders in the Middle East and North Africa region. The three-day summit, was held under the theme ‘AI Impact on the Insurance Value Chain’, and brought together 1,500 participants including 120 speakers, 40 insurance companies, 40 investors, 50 insurtechs, and an assembly of experts, entrepreneurs, regulators and technology partners from across the region and beyond to explore the latest trends and opportunities in the region's fast-growing insurtech ecosystem. which is being transformed by AI technologies.

Sponsoring worthy partners

In January, QIC was the official insurance sponsor of the Katara International Exhibition for Kahraman (Amber)– the first exhibition of its kind in Qatar and the biggest in the Middle East, showcasing authentic Kahraman tailored to all age groups. The following month, the company continued its long tradition of being the official insurer of the Commercial Bank Qatar Masters, the region’s premier golf tournament – where elite golfers competed in a four-day event at the picturesque Doha Golf Club, in the competition’s 27th edition.

In February, QIC Group was the platinum sponsor of the 34th General Conference of the General Arab Insurance Federation (GAIF), the largest regional gathering of insurers and reinsurers, which took place from 19th to 21st February 2024 in Muscat, the capital of the Sultanate of Oman where a regional gathering of insurers and reinsurers came together this year to explore a wide range of topics including the latest trends within the industry, emerging risks, technological advancements, innovative solutions and evolving legislation to address the ever changing needs of customers and markets.

In March, QIC was proud to sponsor the third edition of the Ramadan Football Tournament, hosted by the School Olympic Program, one of the most important projects supporting school sports in Qatar. The event was a huge success, with 400 participants from 32 schools. And in June, QIC celebrated the graduation ceremony of the ninth cohort of the “Kawader Malia” national program, which it has sponsored for three years as part of a commitment to developing human capital in Qatar.

Sustainability, ESG and social impact

Sustainability continues to be a key focus for QIC, as the first insurer in the Middle East to sign United Nations Environment Programme-Finance Initiative’s Principles for Sustainable Insurance (UNEP-FI PSI) last year. The company is upholding its commitment to support Qatar’s efforts to reduce the country’s greenhouse gas emissions by 25% by 2030. QIC has developed an ESG framework and set out a long-term ESG strategy to support Qatar’s ESG commitments and aims to adopt ESG policies into its underwriting and asset management philosophy. An ESG & Sustainability Committee has also been set up to ensure that group-wide efforts are channelled to achieve their goals.

Supporting its social impact goals, in March 2024 QIC opened an interactive edutainment establishment at the KidzMondo Doha theme park in the Mall of Qatar. The mini branch is designed to boost the self-confidence of young people to realise their full potential and offers a fun and engaging introduction to the world of insurance and related industries.

Our People

QIC is extremely proud of the people who contribute in such a variety of ways to the fortunes of the company. In March, the Group honoured its staff at a long service award ceremony, presenting 125 employees across regional and international operations with awards to recognise their invaluable efforts.

Home >> Business and Economy Section

Passenger Growth Hits 5% in May

Nasser Bin Khaled Automobiles Hosts Private Screening of 'F1: The Movie' In coll ...

May Air Cargo Demand Up 2.2% Despite Trade Disruptions

Qatar Insurance Group Earns MSCI's Highest ESG Rating, Cementing Its Leadership ...

Zulal wellness resort partners with qatar airways privilege club to offer exclu ...

Education Above All Foundation Announces New Collaboration with the American Cha ...

Auto Class Cars Launches its Special Summer offer on Maxus D60 and D90 max SUVs

Qatar Automobiles Company – FUSO: Driving Progress Across Industries in Qatar

Dukhan Bank Ranks #62 on Forbes Middle East's Top 100 Listed Companies for 2025

Nissan hosts world premiere of all-new Patrol NISMO in the Middle East, elevatin ...

The Mitsubishi Montero Sport.. Attractive design, High Performance and Durable

Hibrid and Alibaba Cloud Sign MoU to Deliver Advanced Streaming and Comprehensiv ...

CASIO Middle East Africa Marks Six Decades of Calculator Legacy

Dukhan Bank Named “Qatar's Best Bank for Consumers” at Euromoney Awards for Exce ...

Get Ready for Fabulous Summer Looks with BADgal BANG! Power Blue Mascara!

QIC Blog Launches Summer Themed Travel Advisory Series

Doha Mall Expands Dining Options with New Restaurants and the Launch of The Food ...

WCM-Q research highlights Qatar's path to 'global health excellence' in cancer c ...

Msheireb Museums and Sidra Medicine Host Science Café on AI in Precision Medici ...

Artemis Education and Queen's Qatar Launch Sports Centre to Promote Wellbeing